The new whiplash reforms constitute the biggest change to date to the Personal Injury market landscape since the LASPO changes in 2013. The whiplash reforms contained in the Civil Liability Act 2018, announced by the Government back in November 2015 are now set to be implemented with effect from 31 May 2021.

A “whiplash injury” is defined by the Act as "an injury of soft tissue in the neck, back or shoulder that is… a sprain, strain, tear, rupture or lesser damage of a muscle, tendon or ligament in the neck, back or shoulder, or an injury of soft tissue associated with a muscle, tendon or ligament in the neck, back or shoulder." The definition does not include "an injury of soft tissue which is a part of or connected to another injury and the other injury is not an injury of soft tissue in the neck back or shoulder".

New whiplash tariff system

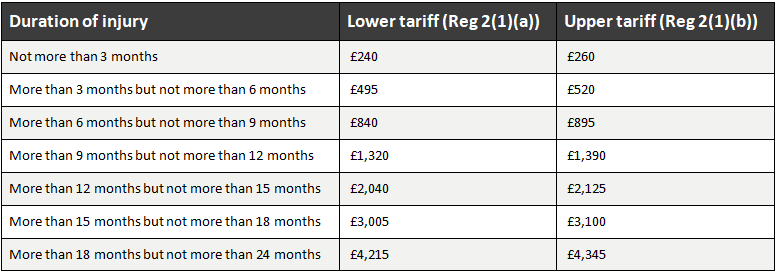

The regulations issued now confirm final details of the whiplash tariff amounts.

There will be two tariffs under Reg 2(1):

(a) a whiplash injury where there is no psychological injury and

(b) a combined whiplash and minor psychological injury (which has not been defined).

It will be open to the claimant to seek an uplift of 20% to the tariff in “exceptional circumstances”. That term has not been defined but it is understood that it will apply where the claimant has increased pain or suffering and loss caused by the whiplash injury only.

New £5,000 small claim limit (which cases will be affected)

The new rules contain the following important rule changes:

- Rule 26.6 is amended to increase the small claims track limit for personal injury claims arising from a road traffic accident to £5,000. The new limit will apply to claims where the accident occurs on or after the 31st May 2021 and applies to the figure for pain, suffering and loss of amenity for the injury alone. The overall Small Track limit for the value of all parts of the claim remains at £10,000. For RTAs before 31st May 2021 and for employer’s liability and public liability accidents and all other injury claims before and after that date the Small Track limit remains at £1,000.

There are some exceptions to the new £5,000 limit and which are excluded from the RTA Small Claims Protocol and the new Portal and these are:

- on the date proceedings start, the claimant is:

- a child or protected party;

- an undischarged bankrupt,

- a personal representative of a deceased person;

- when the accident occurred,

- the claimant was a “vulnerable road user”, (which means, motor cyclists and pillion/sidecar passengers, cyclists, pedestrians, horse riders and those using mobility scooters);

- the defendant’s vehicle was registered outside the United Kingdom; and

NB. children or protected parties – because these claimants are excluded from the new RTA SCT limit and the RTA Small Claims Protocol, they will not be able to source their own medical report, which under the Civil Liability Act 2018 is required to settle claims for whiplash injuries, via the online Service.

New Small Claim PI Protocol

In order to meet the expected increase in Litigants in Person a new amended pre-action protocol for injury claims below the small claims limit in road traffic accidents will take effect from 31st May 2021. The intention is that all claims within the Civil Liability Act will be pursued in line with this framework and through the Official Injury Claim portal https://www.officialinjuryclaim.org.uk.

The protocol will not apply where:

Either party:

- notifies the other through the Portal that the claim has been revalued and that they reasonably believe the overall claim is more than £10,000 or the claim for damages for injury is more than £5,000;

- becomes a protected party as defined in rule 21.1(2);

The Defendant:

a) notifies the claimant through the Portal that the claim is unsuitable for the Protocol because there are complex issues of fact or law;

b) through the Portal makes an allegation of fraud or fundamental dishonesty against the claimant in respect of their claim;

c) disputes or continues to dispute under paragraph 8.9 that the accident caused the claimant any injury following disclosure of a medical report; or

The court: makes an order in other proceedings that the claim must exit the Portal and be added to those proceedings.

When notifying the claimant under paragraph (1)(c) or (d) above, the defendant will be required to explain on the Portal the reasons for their decision why the case is not suitable for the small claims track, including the allegation made under paragraph (1)(d).

Clearly if the claim exits the portal in one of more of these circumstances, the claimant may be left with little option but to seek legal advice.

Along with the tariffs is the prohibition on the claimant making or accepting any offers to settle whiplash claims without a medical assessment.

Overview

With the cost of obtaining an initial report set at £180.00 plus VAT (which the claimant is expected to pay up front) and coupled with the dramatic decrease in damages, it is not difficult to envisage that a large number of claimants will not want to pursue a short duration whiplash claim without legal representation, and without help funding the upfront medical report fee.

The purported aim of the reforms has always been twofold: to reduce the number of minor road traffic accident “whiplash” claims by reducing the compensation for injuries lasting less than 2 years and to reduce the amount an insurer has to pay in legal costs for the claim (by increasing the Small Claims track general damages limit from £1,000 to £5,000).

No doubt in the coming months there will be much debate as to whether claimants are being adequately compensated in view of the set tariffs, and the practical implementation of the portal intended for use by litigants in person.

What is clear is that more personal injury cases will be treated as small claims and this will have an impact on claimant personal injury lawyers dealing with Road Traffic Accident claims in terms of the legal costs they can recover.

It would be wrong to think however that defendant lawyers will entirely benefit. Receiving claim forms directly from litigants in person will bring its own challenges, especially for reserve purposes and important analysis at an early stage. Nevertheless, what is clear is that PI Firms will again be asked to embrace the challenges these reforms bring and will undoubtedly now be planning their approach to deal with the proposed changes.

External links:

Draft Statutory Instruments 2021 No.0000 – The Whiplash Injury Regulations 2021

https://www.legislation.gov.uk/ukdsi/2021/9780348220612/pdfs/ukdsi_9780348220612_en.pdf

The Civil Procedure (Amendment No.2) Rules 2021

https://www.legislation.gov.uk/uksi/2021/196/contents/made

Pre-action protocol for low value personal injury claims below the small claims limit in road traffic accidents. http://www.justice.gov.uk/courts/procedure-rules/civil/cpr-pap-update-feb-2021.pdf

Here at Box Legal we have been offering after the event legal expense insurance since 2004 and have a wealth of experience. We have competitively priced ATE insurance policies available for all types of personal injury claims and can also arrange legal expense insurance cover for non-personal injury claims such as housing disrepair and financial mis-selling.

The number and variety of cases we arrange cover for is always increasing and so please contact us to discuss any after the event insurance requirements. We are happy to discuss and develop ATE insurance for case types we do not already insure.

If you would like to speak to us or obtain further information then please call on 0870 766 997, or email info@boxlegal.co.uk